Semiconductor materials are mainly used in integrated circuits. In China, integrated circuits are mainly applied in computers, network communication, consumer electronics, automotive electronics, industrial control, etc. The total proportion of the top three accounts for 83%. In recent years, a series of policies aiming to promote the development of the IC industry were announced. For instance, the National Integrated Circuit Industry Investment Fund was founded in 2015, which rapidly promotes China's IC industry. In 2015, China's IC industry sales reached 360.98 billion yuan, with year-on-year growth rates of 19.7%; in 2016, China's IC industry sales reached 433.55 billion yuan, with year-on-year growth rates of 20.1%; in 2017, China's IC industry sales reached 541.13 billion yuan, with year-on-year growth rate of 24.8%; China's IC industry sales from January to September in 2018 reached 446.15 billion yuan, with year-on-year growth rates of 22.4%. It can be estimated that by 2020, China's semiconductor industry will maintain a growth rate of more than 20%.

In the field of semiconductor materials, due to the high technical barriers of high-end products and the lack of long-term R&D investment and domestic enterprises, China's semiconductor materials are mostly in the middle and low-end areas in the international division of labor. The high-end products market is mainly monopolized by a few international companies from such as Europe, the United States, Japan, South Korea and Taiwan. For example, the market share of the top six companies in the global market of silicon wafers is over 90%; the market share of the top five companies in the global market of photoresists is over 80%; and the market share of the top six companies in the global market of high-purity reagents is over 80%; the market share of the top seven companies in the global market of CMP materials is up to 90%.

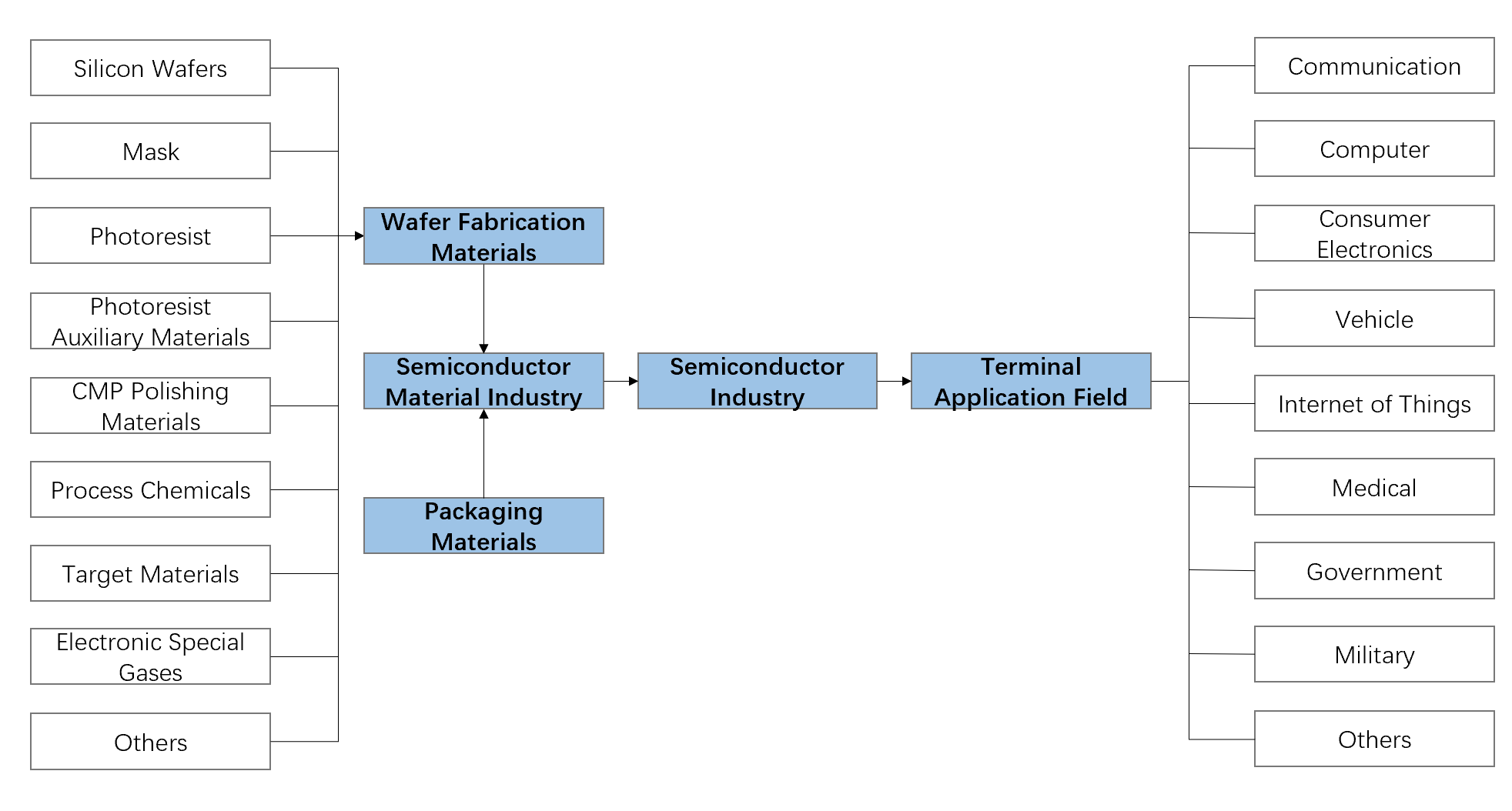

Most domestic products have a low self-sufficiency rate of less than 30% and most of them are packaging materials with lower technical barriers. The proportion of localization in wafer manufacturing materials is even lower, mainly relying on imports. In addition, domestic semiconductor materials companies are concentrated on production lines below 6 inches, and only a few domestic manufacturers have established the 8-inch and 12-inch production line.

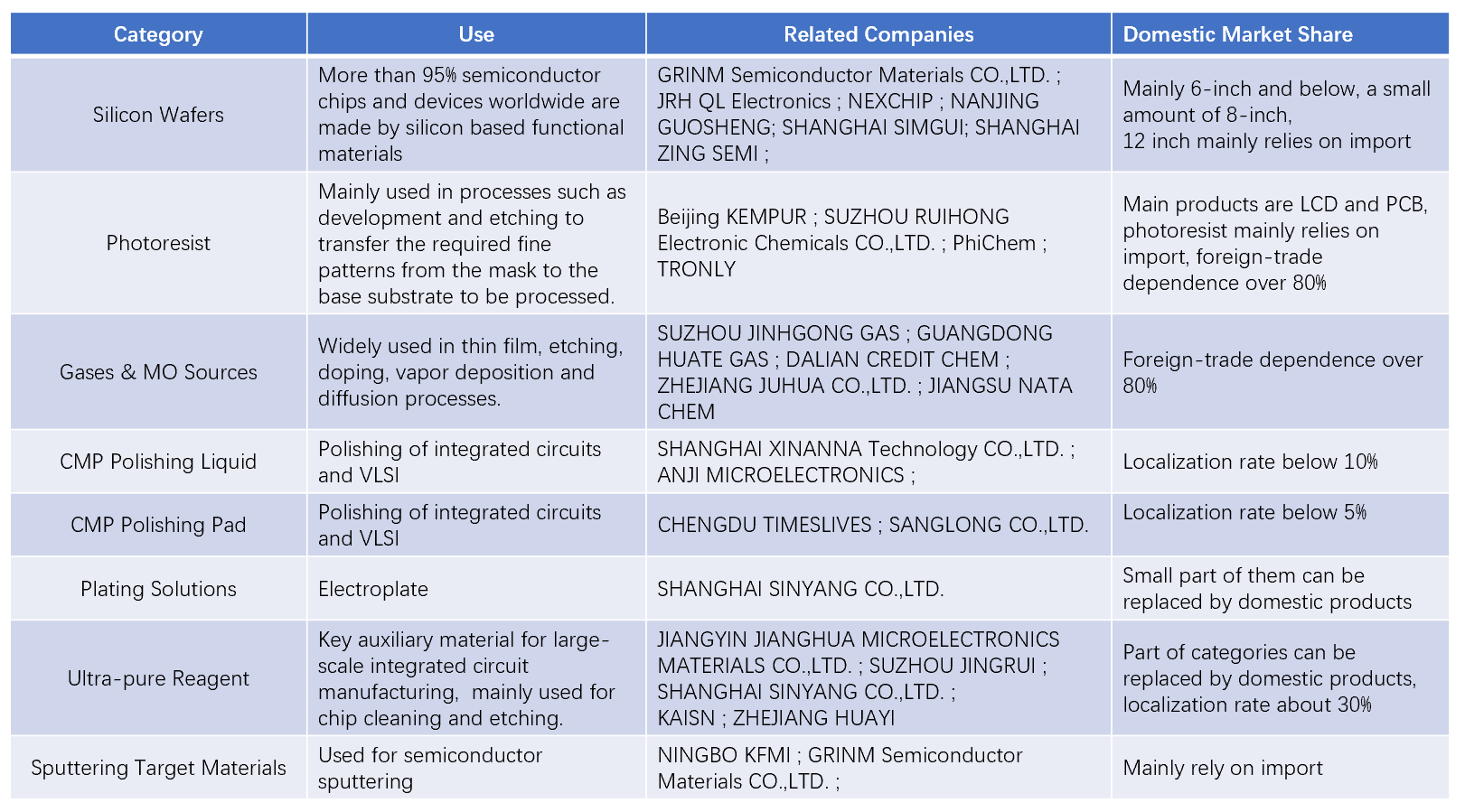

Figure 4.

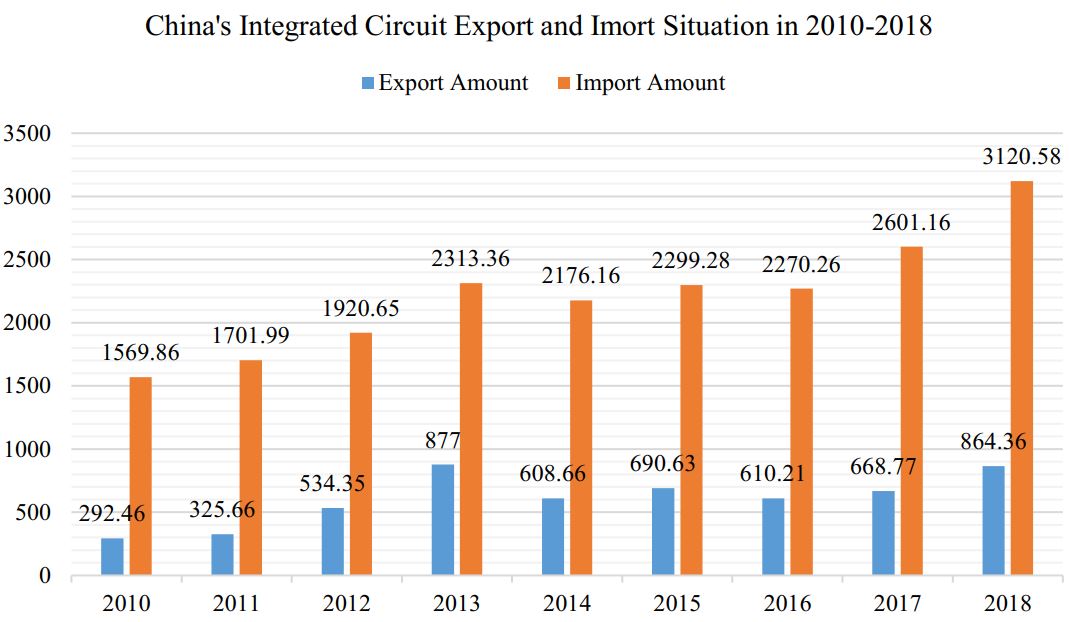

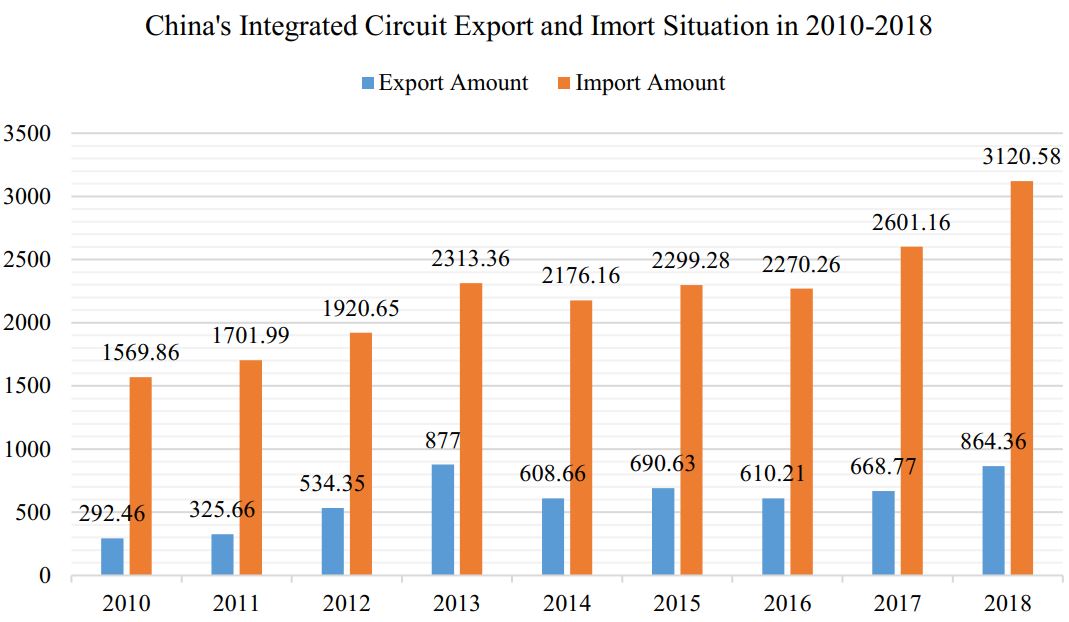

Localization of different types of semiconductor materials. Due to the huge demand and low self-sufficiency rate in China's semiconductor market, China's integrated circuit (commonly known as chip) imports are very huge. In recent years, the import amount of chips was stabilized at more than 200 billion US dollars every year. In the past decade China's chip imports have exceeded the amount of crude oil imports. For example, in 2018, China's chip import amount is 312.158 billion US dollars with year-on-year growth rate of 19.8%, while crude oil import amount is 240.262 billion US dollars. The chip remains on top among China's imported products and trade deficit has expanded year by year. In 2010, the trade deficit of integrated circuits was 127.74 billion US dollars. However, in 2017, the trade deficit of integrated circuits increased to 193.24 billion US dollars, and the trade deficit of integrated circuits in 2018 was 227.422 billion US dollars. Such a large trade deficit reflects the long-term serious shortage of China's integrated circuit market, and the market of import substitution is very potential.

Figure 5.

China's integrated circuit imports amounted to more than 200 billion US dollars, and the import substitution demand is large.